Table of contents

E-car tax: Since 2020, it is even more worthwhile to switch to a company car with an electric drive.

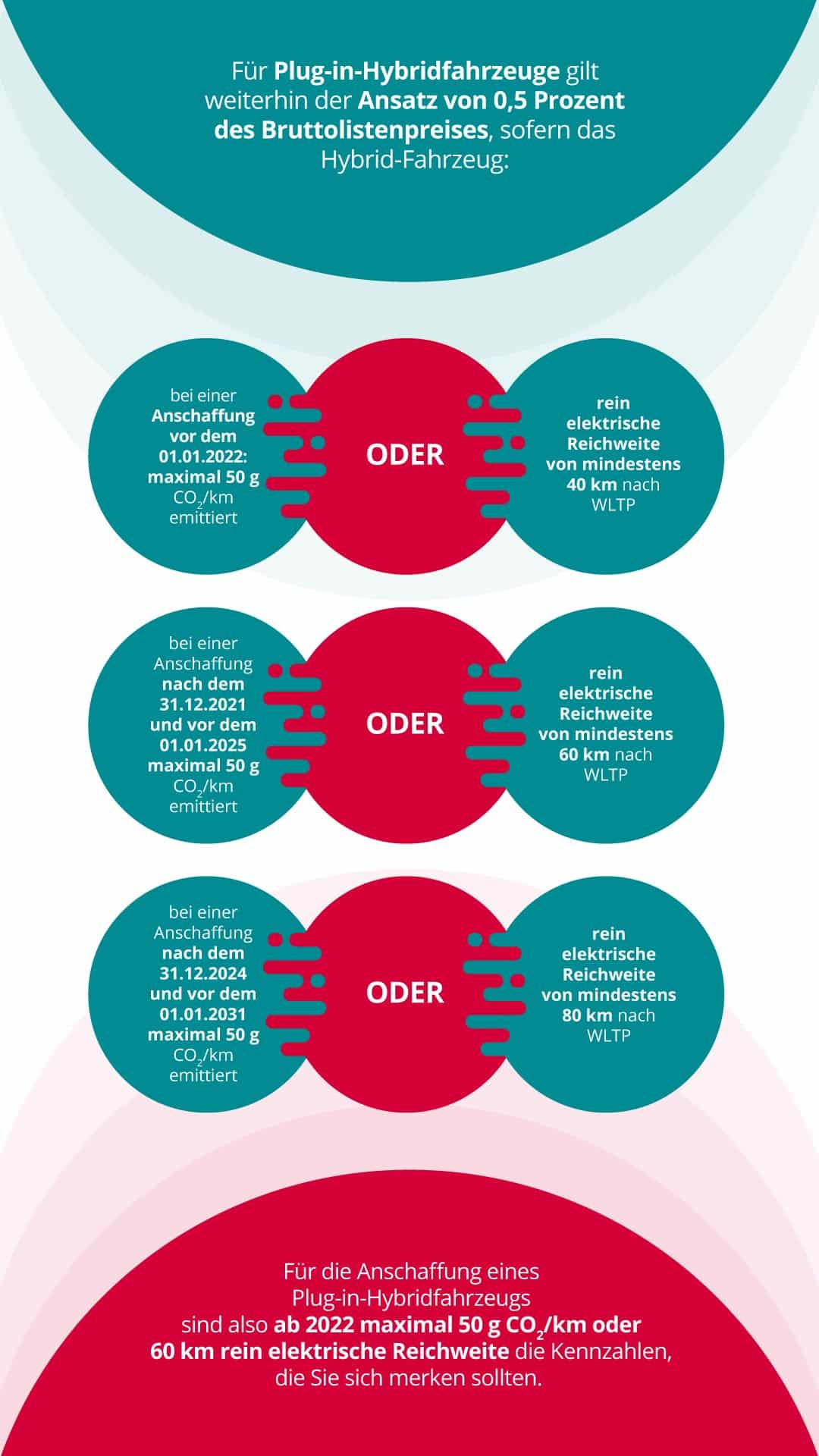

Are you planning to purchase a new company car? Then you could benefit from the change in the law confirmed in the Bundesrat. From 1 January 2020, the private use of electric company cars with a gross list price of up to 65,000 euros, which are used more than half for business purposes, will only be taxed monthly at 0.25 percent of the gross list price as a non-cash benefit (§ 6 para. 1 no. 4 p. 2 no. 3 and p. 3 no. 3 EstG). For hybrid electric vehicles as well as electric vehicles with a higher gross list price, the 0.5 per cent rule remains in force (§ 6 para. 1 no. 4 p. 2 no. 2 and p. 3 no. 2 EStG). For petrol and diesel models, the one per cent rule continues to apply. In the concrete example, this would correspond to a monthly gross advantage of 211 euros, regardless of the taxable commute:

| VW ID.3 Pro (BEV, 204 hp) | VW GOLF Style (BENZIN, 130 PS) |

|---|---|

| Gross list price: 36,960 euros (excl. environmental bonus) | Gross list price*: 30,970 euros |

| Of which 0.25 percent = 92.40 euros taxable imputed income per month | Of which 1 percent = 309.70 euros taxable imputed income per month |

*For comparability, equipment has been added that is standard on the e-Golf

This is what the e-car tax changes mean in concrete terms

The new regulation applies to all vehicles that have been registered or will be registered for the first time in the period from 1 January 2019 to 31 December 2031. The non-cash benefit increases the gross salary subject to tax and social security contributions of the vehicle user, who also uses the vehicle privately, and is subject to the individual tax rate and the personal social security deduction conditions of the employee. The e-car tax savings ultimately result from the reduction to 0.25 percent of the gross list price and thus quarter the tax burden of the privately used company vehicle. However, a quarter of the tax base does not mean only a quarter of the tax. The background to this is the progressive course of the tax rate. When deciding on the next company car, this reduction could be a criterion for opting for a pure e-car. The additionally increased subsidy of up to 9,000 euros for pure e-vehicles remains unaffected.

But beware! The new regulation only applies to purely electric vehicles that meet the requirements of the Electromobility Act (EmoG). In concrete terms, this means that the vehicle

- must be externally rechargeable,

- must not emit carbon dioxide per kilometre driven, and

the gross list price must not exceed 65,000 euros.

What does the BVMW say about the new e-car tax for Saxon companies?

The BVMW has long been calling for a temporary reduction in the imputed income for employees for privately used e-company cars. The federal government's proposal is therefore welcome. However, further measures, such as a special depreciation for charging stations on company premises, are urgently needed to increase the attractiveness of e-mobility. SachsenEnergie adds that there are now various subsidies for company charging infrastructure, such as from KFW.

The SME association BVMW Landesverband Sachsen also argued that the costs for plug-in hybrids and electric vehicles are still high when they are purchased. The regulation is also oriented towards the well-known and understandable system of the one percent rule. In this way, the calculation is as simple as possible and understandable for employees.

If you are also interested in subsidies for public charging infrastructure, we have the right article for you!

Which regulation applies to plug-in hybrids that do not comply with the requirements?

For plug-in hybrids that are purchased before 1 January 2023 and whose emission values or electric ranges do not meet the requirements of the Electromobility Act, the old regulation is applied. The list price is reduced as follows, depending on the battery capacity:

| Year of acquisition/year of first registration | Reduction amount inEuro/kWh of battery capacity | Maximum amount in euro |

|---|---|---|

| 2013 and earlier | 500 | 10.000 |

| 2014 | 450 | 9.500 |

| 2015 | 400 | 9.000 |

| 2016 | 350 | 8.500 |

| 2017 | 300 | 8.000 |

| 2018 | 250 | 7.500 |

| 2019 | 200 | 7.000 |

| 2020 | 150 | 6.500 |

| 2021 | 100 | 6.000 |

| 2022 | 50 | 5.000 |

Source: Federal Ministry of Finance

Option for determining vehicle costs: The logbook method

If you have decided to keep a logbook for your company vehicle, you can rest assured. Here, the depreciation to be taken into account is also quartered or halved. However, you must also fulfil the aforementioned requirements regarding the list price or the range/CO2 emissions when purchasing the vehicle. Since a logbook is very time-consuming to keep and the monetary difference to the aforementioned list price method is smaller than for petrol cars due to the 0.25% regulation, you must decide for yourself whether the method is still worthwhile for you personally. It is also important to note that free or employer-supported charging at the workplace is tax-free. In the case of a leasing or rental car, the acquisition costs are also quartered or halved (§ 6 para. 1 no.4 p.3 EStG), the remaining costs are incurred in full.

If you are faced with the question of whether to buy or lease a car, our article "Electric car leasing: It pays to drive electric commercially!"will help you!

Download our free white paper on the

electrification of your fleet now!

E-car tax: Simplifications for employers and employees

In addition to the 0.25 per cent and 0.5 per cent regulations, the federal government has created further tax advantages and simplifications for privately used electric service cars.

If, for example, the employee charges his company car at home, the employer can reimburse the costs for the charging current without further effort thanks to the so-called flat-rate reimbursement of expenses. Itemised receipts are not necessary here, as administrative costs are to be avoided. The flat rates are

a) in case of additional charging possibility at the employer's premises

- 30 euros for electric vehicles

- 15 euros for hybrid electric vehicles

b) without charging possibility at the employer

- 70 euros for electric vehicles

- 35 euros for hybrid electric vehicles

These lump sums are officially recognised by the tax authorities and are valid until 31 December 2030. In this article you will find more information on the financial benefits for electromobility.

Provision or transfer of a wallbox by the employer

Provision of charging infrastructure to employees free of charge (temporary)

- Monetary benefit, but tax-exempt; cf. § 3 no. 46 EStG

Transfer of the charging infrastructure to employees free of charge (transfer of ownership)

- Monetary benefit with full taxation by the employee or lump-sum taxation by the employer with a tax rate of 25%; cf. section 40 para. 2 sentence 2 no. 6 EStG

Conclusion: It pays to be informed about e-car tax!

Anyone who is thinking of buying an electric company car or converting their fleet to e-mobility will benefit considerably from the e-car tax. The advantage in the tax burden of a privately used electric car of only 0.25 percent of the list price is significant compared to a combustion engine. For plug-in hybrids, you should keep in mind the key figures of a maximum of 50 g CO2/km or a purely electric range of at least 60 km by 2025. Other e-car tax simplifications are also intended to relieve employers and employees. It is therefore worthwhile to keep yourself regularly informed in order to stay up to date.

We update this article regularly so that you can always find the latest facts on electromobility for SMEs on umschalten.de.