The Federal Office of Economics and Export Control (BAFA) received almost 750,000 applications for electric car subsidies by 1 August 2021. Battery electric vehicles (e-cars), cars with plug-in hybrid drive or hydrogen vehicles on this list can be subsidised with up to 9,000 euros environmental bonus incl. innovation premium if they are newly registered after 8 July 2020. The support programme is to be continued until the end of 2025. We have summarised all the important innovations in 2021 as well as an overview of the current funding opportunities for electromobility in this article.

Table of contents

- Environmental bonus for electric cars: What is the "innovation premium"?

- Electric car promotion: How e-commercial vehicles benefit from tax concessions

- Promotion through insurance: Additional profit with the electric car

- Charging station for the electric car: funding possible?

- Conclusion: The possibilities for electric car subsidies are manifold

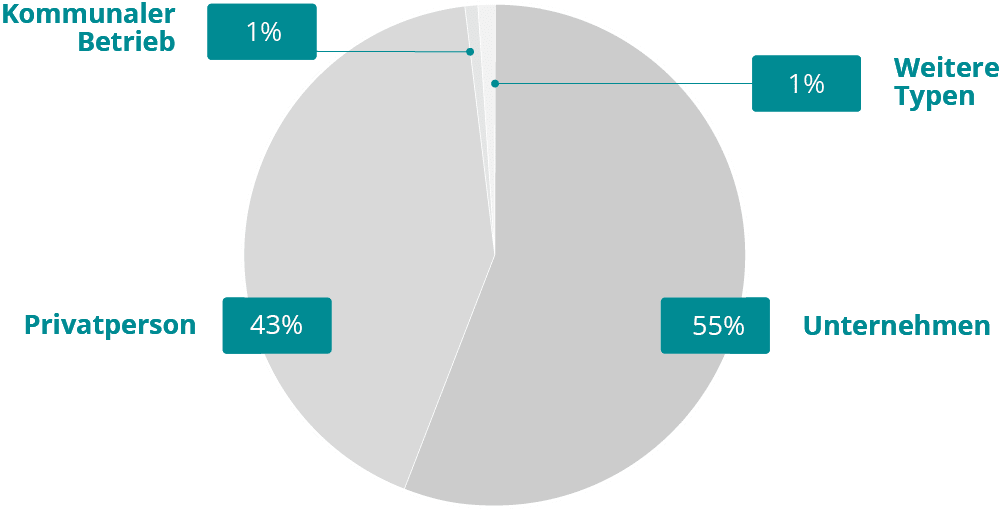

BAFA: SPECIAL COMPANIES APPLY FOR ELECTRIC CAR SUPPORT

The most popular manufacturers in electric mobility are Volkswagen, Mercedes-Benz, BMW and Renault, regardless of the applicant itself. Also in the top 10 are Audi, Hyundai, smart, Tesla, Kia and Skoda.

Source: BAFA "Interim report on the status of applications".

ENVIRONMENTAL BONUS FOR ELECTRIC CARS: WHAT IS THE "INNOVATION PREMIUM"?

Electric vehicles are interesting for companies. An important investment argument here is the electric car subsidy from the Federal Office of Economics and Export Control, BAFA for short, as part of the environmental bonus. In November 2019, the German government announced that it would increase the maximum subsidy per vehicle from 4,000 to 6,000 euros.

Since 19 February 2020, BAFA and car manufacturers each granted a subsidy of up to 3,000 euros for the new registration of an electric vehicle with a net list price of up to 40,000 euros. This new scheme also applied retroactively to all vehicles registered after 4 November 2019. Vehicle owners who had already submitted an application for the previous low subsidy could thus still benefit retrospectively.

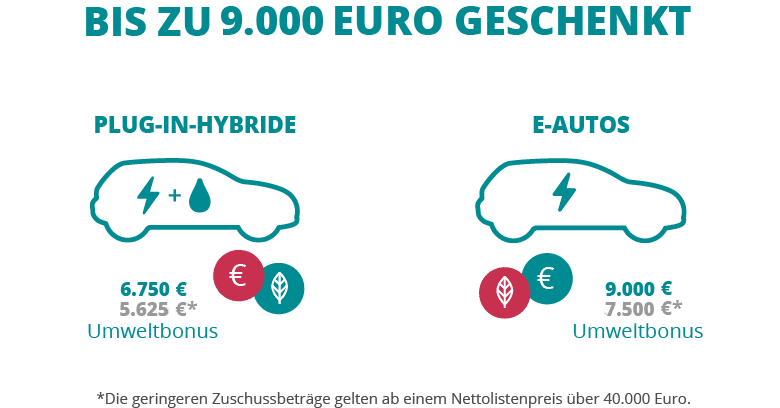

In the course of the Corona crisis, the Federal Government's share of the environmental bonus for electric cars and plug-in hybrids was increased by the so-called innovation premium. For a limited period of time until 31 December 2025, up to €9,000 in environmental bonuses from BAFA and vehicle manufacturers are possible for the purchase of an e-vehicle for new registrations from 8 July 2020!

The funding amounts shown in the chart are valid until 31.12.2025.

Electric cars costing more than 40,000 euros in net list price can be subsidised by the measure with up to 7,500 euros. Plug-in hybrid vehicles are also subsidised by the environmental bonus and innovation premium. Cheaper models below 40,000 euros net list price are discounted by 6,750 euros, vehicles above this net list price by 5,625 euros.

Electric car PROMOTION: HOW E-SERVICE VEHICLES PROFIT FROM TAX BENEFITS

In addition to the well-known environmental bonus, there are numerous other tax advantages if you or your employees drive an e-car for business purposes. The Bundestag and Bundesrat passed a new law last year that grants further benefits to electric mobility.

The imputed income that employees with a company e-car have to pay monthly tax on will be reduced by half again from 0.5 % to 0.25 % of the gross list price as of 1 January 2020, but only for purely electrically driven vehicles up to a gross list price of 60,000 euros. The 0.5 percent rule remains in place for plug-in hybrids - provided they were purchased after 31 December 2018, emit no more than 50 grams of carbon dioxide per kilometre driven and achieve an electric range of at least 40 kilometres. For new registrations from 01 January 2022, the CO2 limit value of a maximum of 50 g must be complied with or a minimum range of at least 60 kilometres must already be achieved for the 0.5% regulation for plug-in hybrids and from 01 January 2025 of at least 80 kilometres.

In concrete terms, the new regulation means that a VW Golf Style with a 130 hp petrol engine (gross list price 30,665 euros) and an e-car VW iD.3 with comparable equipment and 145 hp electric motor (gross list price 35,440 euros) will cost the company car driver just 88.60 euros per month in tax instead of 306.65. This regulation is retroactive and also applies to electric cars purchased since 01.01.2019. Charging on the employer's premises is also guaranteed to remain tax-free until 2030.

But the purchase is also worthwhile for employers as company car buyers. You do not have to pay vehicle tax on all electric cars registered by the end of the year 31 December 2025 for up to 10 years, but at the most until 31 December 2030. After that, you pay a 50 percent reduced tax amount on your e-car. Compared to a diesel model, you can thus save over 2,000 euros. Since 2020, purely electric delivery or other commercial vehicles have also been eligible for a special depreciation allowance of over 50 percent in the year of purchase. This regulation also applies until 2030.

PROMOTION THROUGH INSURANCE: ADDITIONAL BENEFITS WITH THE ELECTRIC CAR

Many insurance companies now have their own offers for electric cars. The focus should always be on what is covered, according to autobild.de. However, electric mobility is no longer a red rag for insurers. Important criteria are the co-insurance of the battery (incl. operating errors), towing operations and the assumption of costs in the unlikely event of a fire. Nevertheless, some car insurance policies for e-cars are also cheaper. HUK-Coburg, for example, currently offers a 20 percent discount on insurance for electric cars.

CHARGING STATION FOR THE ELECTRIC CAR: SUBSIDY POSSIBLE?

However, it has long been the case that not only e-cars can be financially supported. With regard to the funding of charging stations, a distinction must be made as to whether they are publicly accessible or privately operated. In the new directive "Publicly accessible charging infrastructure for electric vehicles in Germany", public charging infrastructure (normal and fast charging points) including installation, grid connection and buffer storage will be funded with a total of 500 million euros until 2025. The funding rate is based on the charging capacity and amounts to 60 percent or a maximum of 2,500 euros per normal charging point with a capacity of up to 22 kW and up to 60 percent or a maximum of 20,000 euros per fast charging point with a capacity of more than 100 kW.

Fast charging points with a capacity of more than 100 kW are also subsidised according to demand. This means that a postcode area with high demand receives a maximum of 60 percent funding, while a postcode area with normal demand receives up to 40 percent funding. The demand is calculated with the help of the StandortTOOL. The grid connection is subsidised by up to 10,000 euros (low-voltage connection) or up to 100,000 euros (medium-voltage connection), depending on the grid connection. The connection of the grid connection and the buffer storage tank is funded with a maximum of 100,000 euros, provided the applicant can prove that a medium-voltage connection would have been necessary without the use of a buffer storage tank.

Especially for municipalities, SAENA - the Saxon Energy Agency - also provides funding for the purchase of consulting services on the topics of electric cars and vehicle fleets, charging infrastructure and alternative mobility solutions.

If you are interested in setting up your own charging station, contact your regional energy supply company, such as SachsenEnergie AG. The colleagues will be happy to advise you on the application process and inform you about new and renewed funding programmes, such as the fleet replacement programme "Sozial & Mobil" for the purchase of e-cars and the associated infrastructure in the health and social sector.

CONCLUSION: THE OPPORTUNITIES FOR PROMOTION OF ELECTRIC CARS ARE VERSATILE

The federal government, the federal states and even some municipalities offer various subsidies for the purchase of electric cars and the associated infrastructure. The pioneer here is the federal state of North Rhine-Westphalia, which offers the most and highest subsidies for electric vehicles. This has a concrete impact: 25 percent of all environmental bonus applications come from NRW. Saxony still has some catching up to do here and, with 2.8 percent of applications, only comes in 9th place in the comparative ranking.

Looking at the number of applications per 1,000 inhabitants, Saxony is even in 14th place. Overall, considerably fewer applications for the environmental bonus for electric vehicles are submitted on average in the new federal states than in the west (5.14 applications per 1,000 inhabitants in the east versus 8.96 in the west).

If you are a small or medium-sized company in Saxony and are interested in the promotion of e-cars and charging stations, you will find information in our Checklist for electric car subsidies a practical aid to print out. In our extensive Whitepaperwhich you can download free of charge, you will also find a wealth of information on charging infrastructure and best practices from Saxony. Do you have any questions or an idea for a topic? Then please send us an e-mail to .